Good news! We finally have a monthly budget template that works for us. It’s not fancy. It’s simple. If you want to take control of your finances, using a budget template is an easy way to make this happen. That is why I made a blank version of our budget template to share for free.

Want to Grab the Free Budget Template Right Now?

You will be required to make a new copy of the google sheet when you go to access it. I hope you find this helpful! (If you are already subscribed and want a copy of the list, just leave a comment.) Let me know if you have any budgeting questions below.

What is a budget template?

A budget template is a way to allocate your income to cover bills, expenses, and savings goals. If you use a budget template regularly, you can start to see major progress with your financial goals. (That was the case for us!)

Finding the right budget template

We have downloaded so many free monthly budget templates only to find them clunky and complicated. A budget template should be easy and simple to use. It should be customizable to your own needs and financial goals. This is why we made our own.

We have used our free budget template for over a year now. We have been able to pay off 40% of student loan debt, save for major house expenses, and continue investing each month. I can’t give all the credit to the budget template, because this took dedication on our part as well. But, the budget template helped us stay on track. It was a way to limit our spending and make our money work for us.

Must Have’s for our free monthly budget template

These were the three essential requirements for our budget template to actually work.

1. Easy to use

Our budget template is on a google sheets, making it easy to use. We can create new tabs for each month at the bottom and look at our budgets over the long term as well.

2. Accessible for both of us

Because we store our budget template with Google drive, we can both have access all the time.

3. Customizable

Our plans and goals change. Sometimes we are saving for a trip and other times we are working on student loan debt pay-off. Our sheet needed to be customizable according to our financial goals.

How to use the free monthly budget template

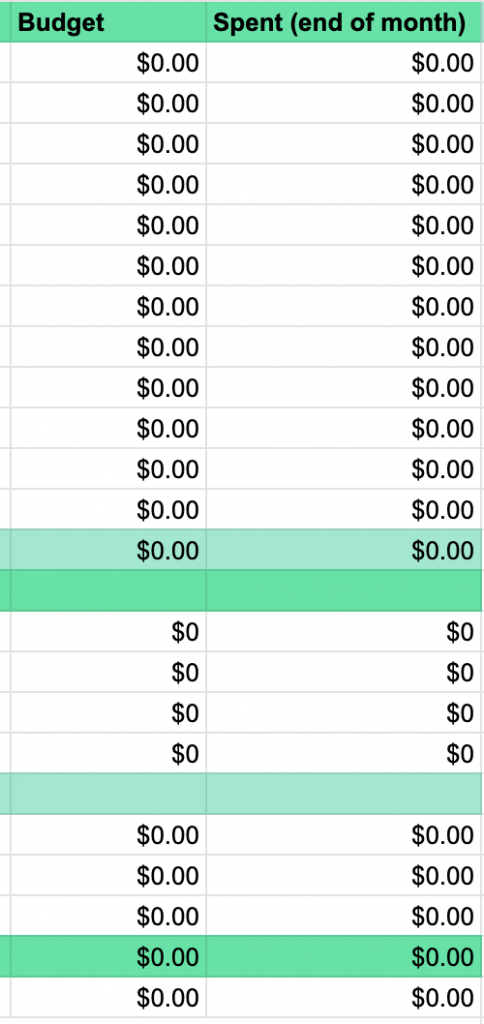

The budget template is simple to use. At the start of each month, you should fill it out. Even is the numbers are estimated you are filling this out as your money goal for the month. This is your budget to try and stick with. At the end of the month, you can back through and input the real numbers in a new collum to see how you did.

Here is your guide to get started using our free budget template.

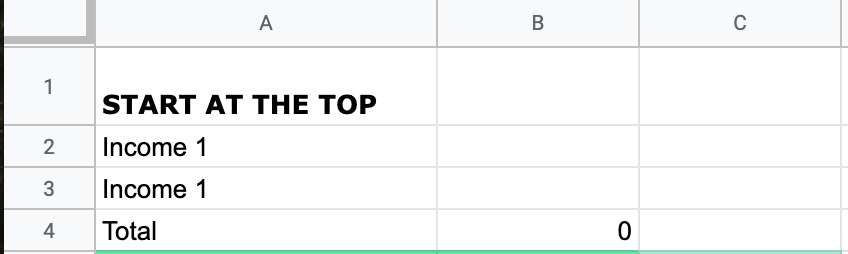

1. Input your total monthly income

If it is only you, then remove “Income 2”.

2. Fill in your monthly expenses

Monthly expenses should include all of your bills, groceries, etc. They might be different from ours, so feel free to change them around.

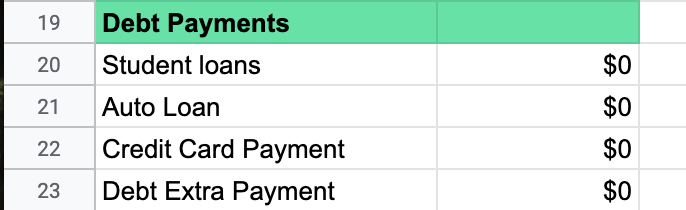

3. Manage your debt payments

Any debt you have should go in this section. We write the minimum payments for each debt and then have a separate line for any extra payments we are making on the debt. You don’t need to do it this way! You can put the full amount you plan to pay off in the line instead and remove the “extra payment” feature.

Note: This section should be for the major debt you plan to pay off, not debt you incur each month but have budgeted for. For example, We buy groceries on our credit cards every month. Groceries already has a line in the budget, so our credit card debt isn’t really debt to us since we pay it off each month. We track the amount on our credit cards using Mint app.

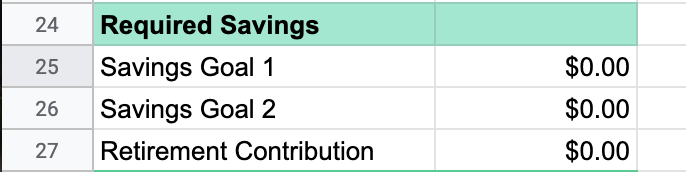

4. Make savings goals

Even if you are paying off debt, you should still be saving and investing a portion of your monthly income. You get to decide what this is, but I recommend you always save for retirement and keep you emergency fund nice and plump.

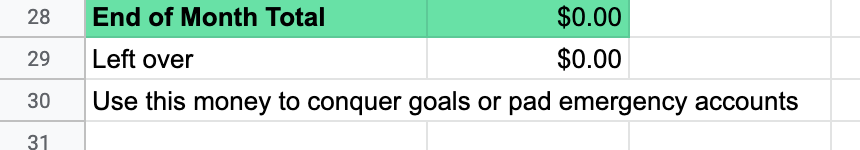

5. Allocate leftover money

Now you can see your monthly total for expenses. You might have leftover money. This money should go towards your big financial goals. If you are doing 0 based budgeting, you will adjust the budget number above until the leftover money is zero.

Here are some ideas for where the left over money should go:

- Emergency fund

- IRA contribution

- Extra debt payment

6. Use the budget template at the end of the month

You made a budget on the first day of the month. At the end of the month it is time to square up. You should look through your bank statements or look at your transactions on an app like Mint. Input your actually spending next to the budget numbers. Hopefully, you staying in budget.

If you have a hard time sticking to a budget and find yourself going over, then I recommend manually tracking your spending week by week. I have a template for this as well.

Copy the Free Monthly Budget Template

Find our free monthly budget template here. You will be required to make a new copy of the google sheet when you go to access it. I hope you find this helpful! (If you are already subscribed and want a copy of the list, just leave a comment.) Let me know if you have any budgeting questions below.

Your Monthly Budget Questions Answered

Below are common questions about monthly budgeting and how to make your budget work for you.

How do I make a monthly budget?

Making a budget for the first time can be scary- we get it. If you follow these simple steps you can get there.

- Identify your income for the month

- Write down your regular monthly expenses including minimum debt payments

- Note any irregular expenses coming up like a birthday or trip

- Subtract these expenses from your income

- Give the “leftover” money a job by putting it in savings or towards debt

Throughout the month you should track your expenses and make sure you are staying on budget. At the end of the month reflect and adjust for the next month.

How does a monthly budget help you?

A monthly budget gives you a roadmap for your money. Not only does it eliminate the feeling of “Do I have enough money to pay for xy and z?” but it will help you reach your financial goals by giving your money a job. Your monthly budget will put your money to work for you.

What is a good monthly budget?

A good monthly budget is the one that helps you reach your goals but also stays flexible. We all know that life can throw us lemons and a good budget should be able to work with that- it’s not written in stone. In my opinion, a good budget will:

- Cover your essential expenses

- Plan for short term expenses like travel or saving for a home

- Save for retirement

- Help you pay off debt and avoid future debt

Most importantly a good monthly budget will give you the control you need over your money.

How much should I budget for gas each month?

According to Quicken, a car and the gas you put in it are the second-highest household expense averaging $813.

You will need to know the following about your car and driving habits to calculate your monthly gas budget:

- Type of car

- Miles per gallon your car averages

- How many miles your drive per month

- How many days a week you drive

- The current gas prices

Using these numbers you can find out what your monthly gas budget should be. You can also input these numbers into a gas budget calculator that will factor this for you.

How do I stick to my monthly budget?

This is the real question, right? Sticking to a monthly budget will be challenging, especially if you have not ever budgeted before.

I would say the most motivating factor for us has been knowing our “why”. Every time I think about making an impulse purchase or going out to eat when we have food at home- I can usually curb this out of budget spending by going back to our “why”. We want to be debt-free, we want to travel more, we want to reach financial independence. These all add up to craving freedom and flexibility. That is how we stick to our monthly budget.